An appraiser or valuer regularly hears things along the lines of “my last appraisal was eight years ago, so I guess it’s gone up since then”.

We do like to think that this is the case, but, sadly, it isn’t always. Some things will go up in value, of course, but others may remain static, or even go down. There are numerous factors that may make an item increase or decrease in value, or bring about no change at all.

Most people don’t expect their car to increase in value (with the exception of some rare collector vehicles). Age and wear and tear play havoc on a car. You rarely expect a ring to go rusty like a well used car, but a gem might chip, or ring might wear thin, an earring become bent or broken.

Outside of damage, there are other reasons why a jewel may change in value.

Fashion dictates prices sometimes. If a celebrity is seen wearing a certain gem, the demand for that type of gem may surge, and the price of that type of gem can increase. When that trend passes, or is eclipsed by another, the price may go down. If you had an appraisal done on your sapphire ring around the time that Prince William gave Kate Middleton her sapphire engagement ring, then the price may have been up, but a few years later, a new appraisal may reflect a lower price, back to the normal.

The economy may cause price differences. As the world becomes more vertically integrated, mining companies are selling directly to consumers, and this can mean more aggressive pricing, and the consumer can sometimes buy for less (but still more than at auction). If lower pricing due to market changes takes hold, then the new lower price becomes the standard, and a new appraisal may reflect the new lower purchase price prevailing in the market.

Supply and demand may affect appraised price. A notable example of supply and demand affecting values is the case of South Sea cultured pearls. These are the large pearls grown in the warm waters of the Pacific, North of Australia, all the way up to Southern Asia. Several years ago, the production of these South Sea cultured pearls increased suddenly, and coincided with an increase in the supply of freshwater cultured pearls from China. South Sea cultured pearl prices plummeted to one quarter of their original retail price, and have not come back. An appraisal from the time of the higher prices will certainly be higher than an appraisal prepared now on the same pearls.

On the other hand, other items will certainly go up. If a gold bracelet was last appraised when gold was $350.00 an ounce, and gold has gone up to $1,400.00 an ounce, then it is very likely that the increase in the price of gold will have pushed the appraisal on the bracelet up, too.

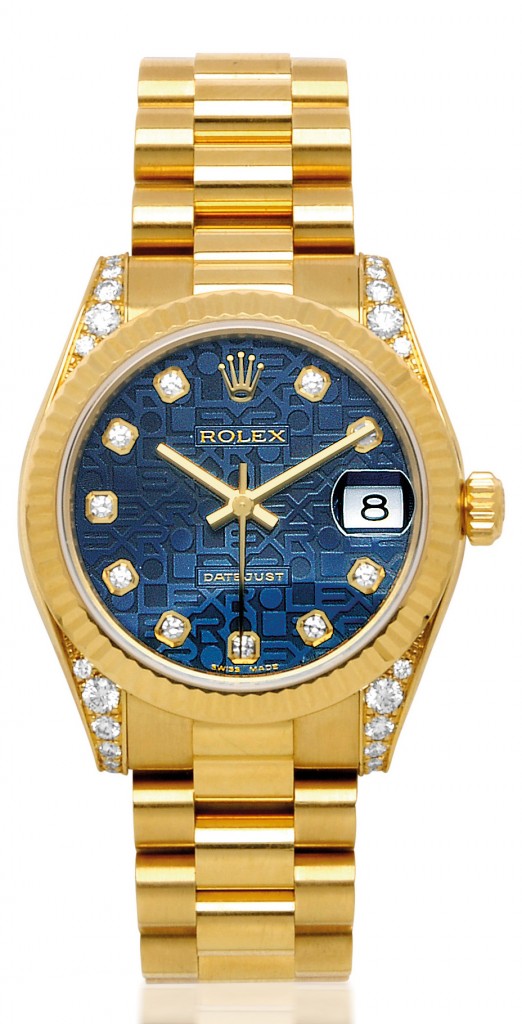

Another factor is other cost increases, if an item has a large labour costs or established list prices, it may be that it has increased in appraised value. If there is a fine timepiece, and the retail price has increased, the appraisal will have gone up. If a jeweller is producing jewels in a market where the labour costs are increasing, the price of an item from them may increase, and an appraisal should increase to reflect that.

At auction we see all of these types of jewels, and often see appraisals that accompany them. The appraisals are usually for “replacement value”, calculated at an estimate of the cost to buy a new replacement at full price in a regular retail environment. The amount something may sell for at auction is estimated at “fair market value”, and this is a different amount again. Fair market value is established through comparison to recent auction results for the nearest equivalent item that has recently sold at auction.

An auction aims to sell your jewels at the highest price possible by exposing them to thousands of potential bidders. It is extremely rare, however, to be able to realize the retail appraised value for an item of jewellery or watch sold at auction. We get as close as the bidding takes it, and generally have a reserve (minimum), so you know it won’t go below an agreed amount.